How Credit History Repair Service Functions to Remove Mistakes and Increase Your Creditworthiness

Credit repair is an important procedure for people looking for to enhance their creditworthiness by attending to mistakes that might jeopardize their monetary standing. By diligently examining credit reports for usual errors-- such as incorrect personal details or misreported settlement backgrounds-- individuals can launch an organized dispute procedure with debt bureaus.

Understanding Credit Information

Credit report records serve as a monetary snapshot of a person's credit score background, detailing their loaning and repayment behavior. These records are put together by credit score bureaus and include critical details such as credit accounts, arrearages, repayment background, and public records like liens or personal bankruptcies. Banks use this information to assess a person's credit reliability when using for finances, bank card, or home mortgages.

A debt report commonly consists of individual details, including the person's name, address, and Social Security number, along with a listing of charge account, their standing, and any type of late settlements. The report also outlines debt inquiries-- instances where lending institutions have accessed the record for evaluation functions. Each of these parts plays an important function in establishing a credit report, which is a numerical representation of credit reliability.

Recognizing credit report records is important for customers aiming to handle their monetary health and wellness effectively. By consistently reviewing their reports, individuals can make certain that their credit report properly shows their economic habits, therefore placing themselves positively in future loaning undertakings. Understanding of the materials of one's debt record is the primary step toward successful debt fixing and general monetary wellness.

Common Credit Rating Record Errors

Mistakes within credit reports can considerably impact a person's credit history and total economic health and wellness. Usual credit record errors consist of incorrect personal information, such as incorrect addresses or misspelled names. These disparities can cause confusion and might impact the evaluation of creditworthiness.

An additional regular error involves accounts that do not belong to the person, commonly arising from identity theft or inaccurate data entry by lenders. Mixed data, where a single person's credit scores details is integrated with one more's, can also happen, specifically with individuals who share similar names.

Additionally, late settlements may be wrongly reported because of refining errors or misunderstandings concerning repayment dates. Accounts that have actually been cleared up or repaid might still look like outstanding, additional making complex a person's credit rating account.

In addition, inaccuracies pertaining to credit line and account equilibriums can misrepresent a customer's credit scores application proportion, a vital variable in credit scores scoring. Acknowledging these mistakes is crucial, as they can lead to greater rates of interest, lending denials, and raised difficulty in obtaining debt. Frequently examining one's debt report is a proactive measure to determine and correct these typical errors, therefore guarding financial health and wellness.

The Credit Scores Repair Service Process

Browsing the credit scores repair work process can be a complicated job for several people looking for to enhance their monetary standing. The trip begins with acquiring a comprehensive credit rating report from all three significant credit scores bureaus: Equifax, Experian, and TransUnion. Credit Repair. This enables customers to determine and recognize the factors impacting their credit report

As soon as the credit history report is examined, individuals should classify the info into precise, incorrect, and unverifiable products. Exact information needs to be kept, while inaccuracies can be opposed. It is important visit the site to gather supporting documentation to substantiate any kind of claims of mistake.

Next, individuals can pick to either manage the process individually or employ the aid of professional credit history repair services. Credit Repair. Specialists commonly have the expertise and resources to browse the intricacies of credit score reporting laws and can simplify the process

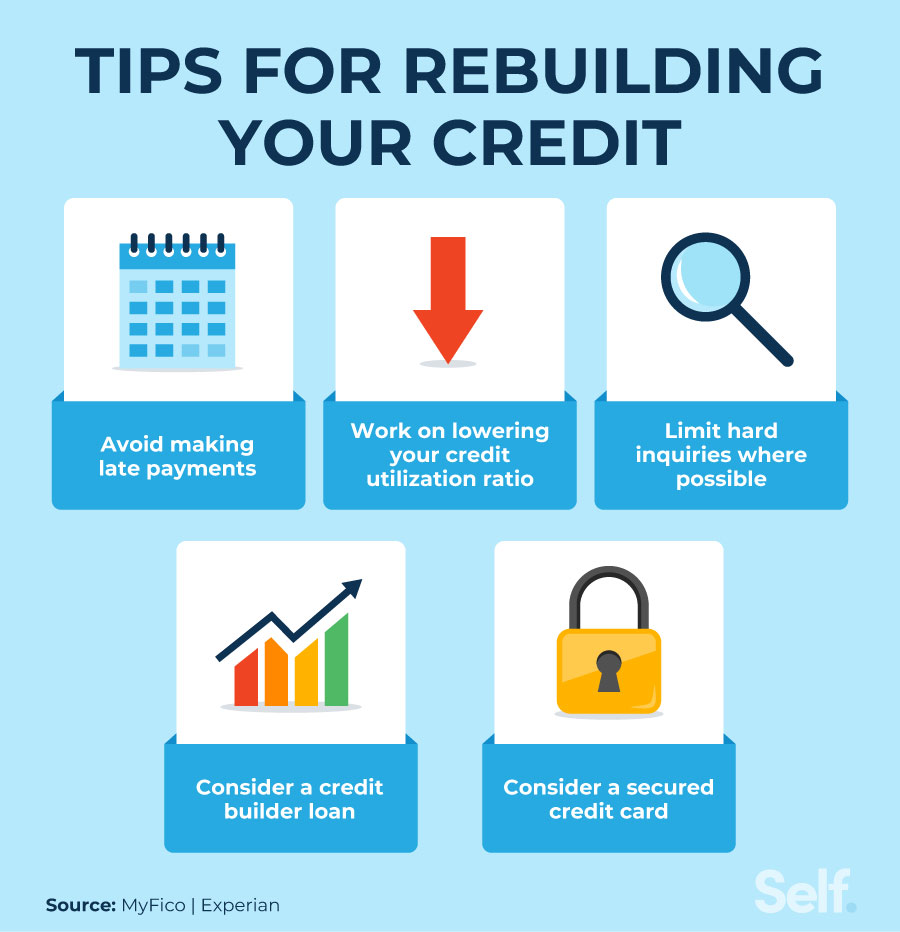

Throughout company website the credit history repair service process, maintaining prompt settlements on existing accounts is crucial. This demonstrates liable financial behavior and can positively impact credit rating. Eventually, the debt repair service procedure is an organized strategy to determining issues, contesting inaccuracies, and fostering much healthier monetary behaviors, leading to enhanced credit reliability gradually.

Disputing Inaccuracies Effectively

An efficient disagreement process is crucial for those wanting to correct errors on their credit history reports. The very first step involves getting a copy of your credit scores report from the significant credit report bureaus-- Equifax, Experian, and TransUnion. Testimonial the record meticulously for any kind of discrepancies, such as wrong account information, outdated info, or illegal access.

Next off, launch the conflict process by getting in touch with the credit report bureau that provided the record. When sending your dispute, give a clear explanation of the error, along with the supporting proof.

Benefits of Credit Rating Repair Service

A wide variety of benefits accompanies the procedure of credit score fixing, dramatically affecting both monetary security and general lifestyle. One of the key benefits is the possibility for enhanced credit rating. As errors and mistakes are fixed, people can experience a significant rise in their credit reliability, which directly influences finance approval prices and rate of interest terms.

Furthermore, credit fixing can boost access to desirable funding options. People with higher credit rating are more probable to get approved for reduced rate of interest on mortgages, automobile fundings, and individual loans, inevitably leading to considerable savings over time. This better financial versatility can promote significant life decisions, such as buying a home or investing in education and learning.

With a more clear understanding of their debt situation, individuals can make educated choices pertaining to credit use and administration. Credit rating fixing often entails education and learning on monetary literacy, encouraging people to adopt better costs routines and maintain their credit scores health lasting.

Conclusion

In conclusion, credit report fixing offers as a crucial system for improving credit reliability by addressing additional resources inaccuracies within debt reports. By understanding the nuances of credit report records and utilizing efficient conflict methods, people can attain greater economic wellness and security.

By diligently checking out credit rating reports for usual errors-- such as incorrect individual information or misreported payment histories-- people can launch an organized dispute process with credit rating bureaus.Credit scores reports offer as a monetary photo of an individual's credit background, outlining their borrowing and repayment actions. Recognition of the contents of one's credit history report is the initial action toward successful credit fixing and general financial wellness.

Mistakes within credit score records can substantially impact an individual's credit score and general financial health.Moreover, mistakes concerning credit rating restrictions and account equilibriums can misrepresent a customer's credit history utilization proportion, an important factor in credit report scoring.

Comments on “Increase Your Score: Effective Methods for Credit Repair Revealed”